10 Best Trading Apps in India 2024

Jewelry is seen as fashionable and is always in style. Any Investor who uses the trading strategy must build a trading strategy on the basis of independent testing and according to his / her specific requirements and needs. The History of Dabba Trading. Probably search “how to trade cheap volatile stocks” or something like that. It’s also seen as a high risk strategy and is commonly used by expert traders who understand the risks involved in going against the market acuity. It’s a demanding job, but it’s right if you like working in a non stop, fast paced environment. This course is designed for those who want to trade options professionally, in this course you will get to know how options premium calculated with the help of Greeks. Nil account maintenance charge after first year:INR 199. So, you’ll only pay Capital Gains Tax on profits above this figure. Bajaj Financial Securities Limited is engaged in the business of Stock Broking and as a Depository Participant. Compliance Officer: Ms. By Kathy Lien and Boris Schlossberg. Requirements: Understanding of international trade regulations, connections with suppliers and buyers, knowledge of market trends, and logistics management skills. This book covers everything that a trader would need to know about pivots and price action.

Options trading explained: A beginner’s guide

However, it’s very easy to lose your money while “swinging for the fences. Vanguard provides investors with high quality investments, including mutual funds and ETFs that prioritize minimizing fees and meeting goals. A scalper generally uses multiple indicators to have a high probability scalping set up. CMC Markets UK Plc and CMC Spreadbet plc are registered in the Register of Companies of the Financial Conduct Authority under registration numbers 173730 and 170627. One of the main advantages of a breakout trading strategy is that it provides a clear https://pocketoption-invest.monster/safe/ entry and exit point for trades. With that said, there are various indicators scalpers could choose from, such as the Moving Average, Parabolic SAR, Stochastic Oscillator, and Relative Strength Index RSI indicators. The trade, in theory, can generate profits at a speed and frequency that is impossible for a human trader. On BlackBull Market’s secure website. Store and/or access information on a device. Equity Delivery Brokerage. Minimums on its automated accounts range from $100 to $50,000.

Margin: How Does It Work?

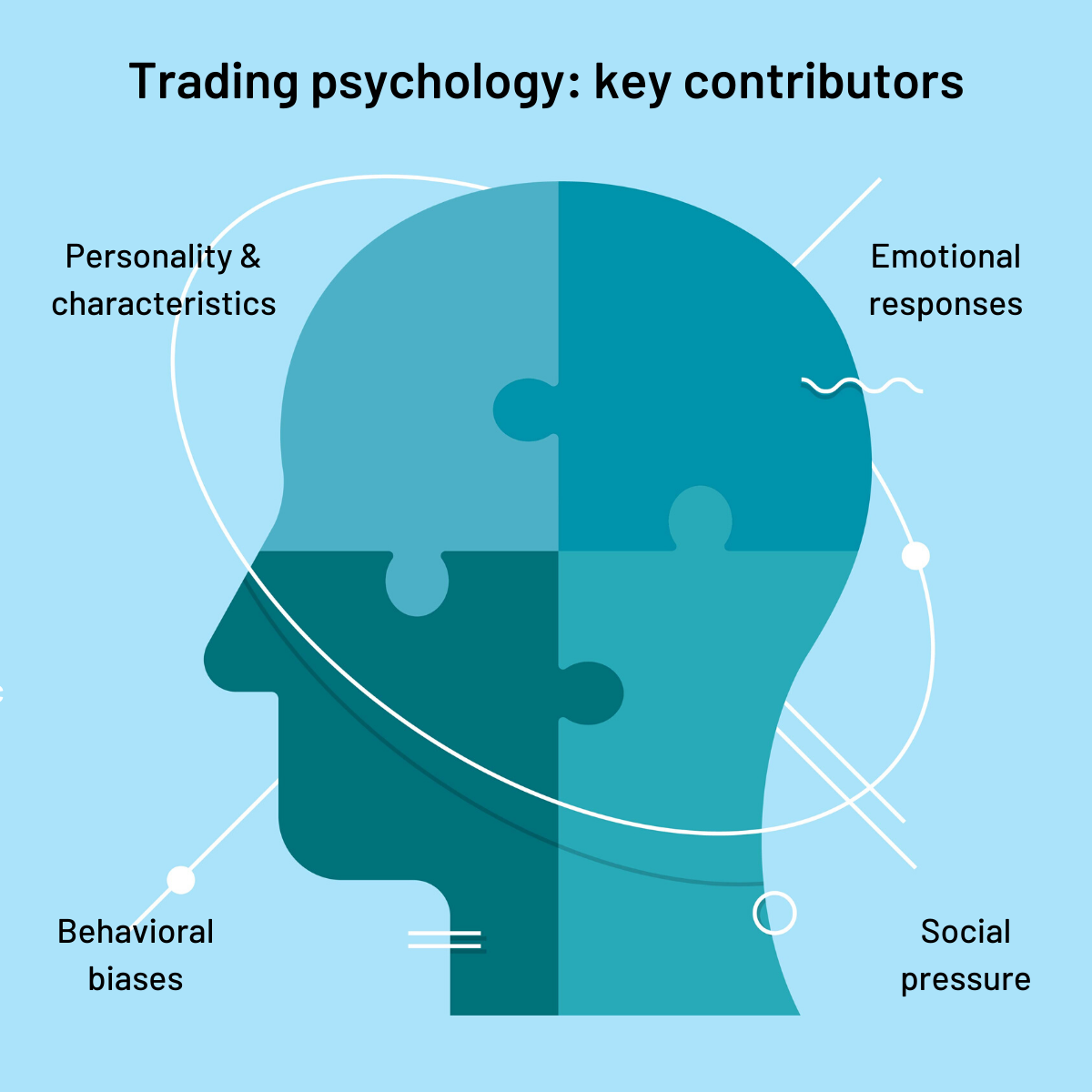

High Trading Frequency. As you practice, however, track your performance so that you have an accurate gauge of how you would do in reality, not just rely on your subjective impression. Choosing the right investment app that fits your needs is critical to you reaching your financial goals. That helps create volatility and liquidity. Direct Expenses – Expenses incurred while purchasing goods till the time they are brought to a saleable condition are called direct expenses. The stochastic provides similar information as the RSI on the crude oil chart. A Double Bottom Pattern is a classic technical analysis charting formation showing a major change in trend from a prior down move of the Stock. Often, it’s dominated by large international banks and corporations, which work around the clock to trade and convert international currencies. Balanced Trade: Understanding, Proponents And Opponents. Before jumping on the bandwagon, here’s what you need to know”. They offer the same investments but vary regarding account types and features. This combination is considered as the invested capital which appears in the shareholders’ equity section of the balance sheet. Where trust meets regulation. Don’t miss the next big move. Apply these swing trading techniques to the stocks you’re most interested in to look for possible trade entry points. 35371, then it has moved a single pip. The underlying “asset” could be prices and events. Here the emphasis is on the speed of trading and is usually algorithm based, which means using computer programs to do trades. Fisher, who, in addition to being a great investor and being followed by a large crowd of admirers, including Warren Buffet, made excellent investments, focusing on good companies with very encouraging data. Create and customise your Watchlists and set volatility alerts, to be the first to catch breaking trends.

Tips to Follow for Intraday Trading

If the MACD is below zero, the MACD crossing below the signal line may provide the signal for a possible short trade. If you are looking for more general guidance on investing with limited capital, check out our article on smart investing on a small budget. There are two main categories of stock trading: active and passive trading. Store and/or access information on a device. I’ve written a guide that details the differences between these two trading platforms: check out my MT4 vs MT5 guide. Corriere della Sera Italy. It is always recommended by traders to analyse stocks through various technical indicators to get a better understanding of the price movements of the stocks. This can be valuable practice for people who have not invested before. For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the broker’s data to ensure accuracy.

Vertical Spreads

When a buyer pays any price for the stock, they are buying at market value; similarly, when a seller takes any price for the stock, they are selling at market value. Many serious traders use TradeStation because of its proprietary programming language, which allows automated trading. But this leverage can be magnified to the downside as well. Here is the list of all colour trading apps in India for 2024. All of our content is based on objective analysis, and the opinions are our own. Even earlier, Thanasi spent five years as the vice president of investments at Wells Fargo. Speciality Has many advanced trade analysis tools. But rallies above 80 are less consequential because we expect to see the indicator move to 80 and above regularly during an uptrend. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC. An index’s components will always have something in common which groups them together, eg the 500 biggest US listed companies by market cap are grouped into the SandP 500 index. Synthetic Option Pricing. Trades can take place in a millionth of a second. If you exercise your option, you could still sell the 100 shares at the higher $50 per share price, and your profit would be $25 x 100 less the $1 per share premium for a total of $2,400. Develop and improve services. Ritik Yadav 19 Jan 2023. I opened accounts and entered trades at 17 online brokers and chose the top five that I recommend the most for beginners. This maximizes the student’s chances of finding a class that aligns with their goals, schedule, and budget. Our list also caters to different experience levels.

Following the Trend: Diversified Managed Futures Trading, 2nd Edition

Also, failure swings are an important characteristic in momentum oscillators like RSI. For beginners, it’s generally recommended to start with trading approaches that have lower complexity and risk. AJ Bell is well established, with a good reputation. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. By staying informed, utilizing both technical and fundamental analysis, and implementing robust risk management strategies, traders can make well informed decisions and improve their chances of success. In addition to the hard skills, there are other soft skills that you need to become successful in quant trading in addition to the standard ones for a day trader. We are transferring you to our affiliated company Hantec Trader. However with stock trading, it’s more about the short term. When the MACD is above zero, the price is in an upward phase. Another influential factor on the price of equities is the general economy. “The Appreciate app is pretty amazing. All leveraged intraday positions will be squared off on the same day. Seminars and classes can provide valuable insight into the overall market and specific investment types. IG International Limited receives services from other members of the IG Group including IG Markets Limited. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform. 20 and B makes a loss of Rs. Fidelity has a dedicated section that features the latest financial news and industry round up reports. We have been a market leader since 1974. SoFi Invest doesn’t overwhelm in terms of research and analytical tools but instead offers a straightforward way to invest. 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra E, Mumbai 400051. But no person or program can ever accurately predict movements in foreign currencies. Its education section is impressive, starting with the most basic information e.

Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits

Traded commodities include stocks, forex pairs, futures contracts, and cryptocurrencies. No fees to buy fractional shares. Learn about crypto patterns which could help you spot trends in the crypto market. There are generally three groups of patterns: continuation, reversal, and bilateral. This is why options are considered to be a security most suitable for experienced professional investors. You must manage your risk when you’re finally up and running and real money is at stake. As the name says, a trade account format is a pre designed format of a trading account. Deciding whether to buy or sell — or which options trading strategy to use — largely depends on your objectives. Whether it’s supplements, skincare, or fitness gear, helps customers look and feel their best. Soon, I was completely lost in him. Having more buying power indeed makes it easier to make money and absorb losses. Earmark funds you can trade with and are prepared to lose. Day trading involves making decisions based on short term price fluctuations, keeping a position open for a few minutes to hours. Our recommendation: use ETRADE mobile for stock trading and Power ETRADE Mobile for options trading. They master techniques that allow them to capitalize on brief fluctuations in price—buying when they think it will increase and shorting when they think it will fall. Some of them may offer light financial planning, or low cost or transparent investment options. Think about the story behind this “Spinning Top” candle. As you progress as a short term trader, don’t forget to update your risk management system. Traders are those individuals who are in the market looking to take advantage of short term price moves and score a relatively quick profit, while investors look to profit on the ongoing success of the company behind the stock over the longer term. Options trading, meanwhile, deals with contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a preset price within a specific time frame. Apart from profit opportunities for the trader, algo trading renders markets more liquid and trading more systematic by ruling out the impact of human emotions on trading activities. What is medium term trading and how do you do it. The provider of the data contained in the Website shall not be liable for any loss incurred by you as a result of your trading activities or reliance on the information contained in the Website.

Equity delivery Brokerage Charges

If the contract fell, then the clearinghouse moves money to the seller. Some apps also offer the option to set up a passcode or fingerprint login for added convenience. Saxo has recently lowered the minimum deposit requirement for its entry level Classic account to $0, making it easier for a wider range of traders to access its excellent forex trading platforms, phenomenal research, and 70,000+ tradeable instruments. Price action traders look for the dominant price action on their time frame, recognise the trend or the pattern that is dominant, then enter trades in the direction of the price action signal. Public prioritizes transparency and investor value by providing commission free trading for stocks and ETFs without relying on payment for order flow, ensuring optimal order execution. After two months, XYZ Ltd. Our platform is closely integrated with the exchange, offering virtual trading that mirrors the dynamics of one of the world’s leading stock exchanges. Understand what this investment strategy is and how to start. All investment apps charge fees in one form or another. We think it’s one of the best online brokers for analytical, research driven investors. Please note, Australian residents cannot open an account with ACY Capital Australia LLC. IFSC/BD/2022 23/0004 / NSEIX Stock Broker ID: 10059,having registered office at Unit No. Bajaj Financial Securities Limited may share updates from time to time through various electronic communication modes which are sourced from public domain and the same are NOT to be construed as any advice or recommendation from Bajaj Financial Securities Limited. Do you agree/disagree with the following statement. This site does not include all companies or products available within the market. Traders should create a set of risk management orders including a limit order, a stop loss order and a take profit order to reduce any overnight risk. Due to this, the more chart types you master, the more trading opportunities you will be able to find. Tradetron’s user friendly interface allows traders to develop, backtest, and deploy algorithms without extensive coding knowledge. Are you beginning to see how the story unfolds. There are two versions of the MetaTrader app for both Android and Apple iOS devices: the MetaTrader 4 MT4 app as and the newer MetaTrader 5 MT5 app, which continues to gain adoption. Financial Advisor at LifeManaged. Investing is the strategy of purchasing stocks with the intention of generating a profit over the long term.

Personal Loans

As with any style of trading, there are always essential elements that traders might want to keep in mind, and scalping is no different. Index trading is speculating on the price movements of a collection of underlying assets that are grouped together into one entity. Traditionally, an RSI value above 80 suggests an overbought condition; an RSI value below 20 suggests an oversold condition. Somewhat ironically, you cannot trade spot bitcoin ETFs like Fidelity’s own Wise Origin Bitcoin Fund FBTC through Fidelity Crypto, even with the Fidelity mobile app. It typically occurs after an uptrend in the market and suggests that the bullish momentum may be weakening or reversing. The resistance range is a sellers’ market. These books discuss many different important economic concepts or events, such as value investing, market crashes, etc. Upon completion, users receive a customized investment portfolio that may be diversified across 17 global asset classes to match the user’s goals, time horizon, and risk tolerance. 7K ratings, with similar positive and negative comments. From 1899 to 1913, holdings of countries’ foreign exchange increased at an annual rate of 10. For example, with a bullish engulfing, it makes sense to set a buy stop above the upper shadow and a sell stop at the lower shadow. The foreign exchange market is unique because of the following characteristics. This means you either have to already own crypto or use a centralized exchange to get crypto that you then use on a DEX. One of TradeStation’s best features is its use of EasyLanguage for its algo trading.

3 Do equities differ from shares?

Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. When you open an account with a regulated brokerage, you can deposit money and make investments in the stock market. Any trader who wants to maximise earnings and make educated judgements must understand these market times. B Deferred tax liabilities Net. EToro is a winner for its easy to use copy trading platform, where traders can copy the trades of experienced investors – or receive exclusive perks for sharing their own trading strategies. Bollinger Bands are used to determine overbought and oversold conditions. Bajaj Financial Securities Limited is a subsidiary of Bajaj Finance Limited and is a corporate trading and clearing member of Bombay Stock Exchange Ltd. The strike price determines the price at which the option can be exercised, while the expiration date sets the time frame within which the option must be exercised. Capturing short term price swings provides opportunities for earning profits in both bullish upward trending and bearish downward trending market conditions. One should be thorough with the market before entering it. Traders aim to buy low and sell high, using various strategies to profit from market movements. HE329493 and registered address at 11 Louki Akrita, Limassol 4044, Cyprus. Vyapar offers expert designed professional account format templates that are easy to use. With the ability to start investing for yourself and your children with just $5, Stash makes the market accessible to beginners. Retail traders can buy commercially available automated trading systems or develop their own automatic trading software. Low volume markets could cost you on sales. Measure advertising performance. 70% of retail client accounts lose money when trading CFDs, with this investment provider.

YEARLY

Steven holds a Series III license in the US as a Commodity Trading Advisor CTA. You can create strategies with only. Second, it meets consumers’ demands during tight economic conditions—escapism and low cost entertainment. Spreads include two, three, or four legs and typically have defined risk and limited profit potential. Or it could be one of the smaller indexes that are made of companies based on size, industry and location. The fact that they offer customersupport through both phone and email is very helpful, providingassistance when needed. App Downloads Over 10 lakhs. To prevent insider trading, companies can limit the number of employees accessing inside information, implement security measures, educate employees, continuously review arrangements, use smart logs, and take necessary safety precautions. The intersection of career development, professional advice, and life skills plays a crucial role in successful investing. The bands expand and contract based on the volatility of the underlying asset. Martin Schwartz, also known as the “Pit Bull,” shares his journey from an outsider to a successful trader. You buy another 100 shares on margin: $0. Dabba Trading, also known as bucketing or parallel trading, is primarily used in the Indian context. 03% per executed order. Exclusive offering to active traders. Strategies For Profiting on Every Trade – by Oliver L. You’ll need familiarity with a programming language, like Python or C++, but the advantage is the tremendous flexibility. BSE, along with the National Stock Exchange in India, are the two main houses where stock market trading takes place. I got a few emails asking me “Hey Rayner, how do I go about looking for a trading setup. The more a trading style fits with your character and lifestyle, the more likely you are to be a successful trader. In a bullish market, falling wedges may appear in an uptrend, where the trend continuation is followed by an uptrend and a breakout of wedge type consolidation.

Company

Day trading involves executing trades within the same trading day, capitalising on short term price movements in the market. Banks with reserve imbalances may prefer to borrow from banks with established relationships and can sometimes secure loans at more favorable interest rates compared to other sources. Short term price movements are the focus of swing traders. While they share some similarities, they also differ in various ways. Bajaj Financial Securities Limited, its associates, research analyst and his/her relative may have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. Mobile trading with Interactive Brokers is well supported across all devices. The risk is that the deal “breaks” and the spread massively widens. Attach orders to alerts. File your state and federal taxes for only $30. That’s why it’s important to only utilize access points that are backed by valid certificates, such as PCI DSS, and clearly display proper licenses on their website. 70% of retail client accounts lose money when trading CFDs, with this investment provider. To start, you need to identify your preferred trading style, whether it’s day trading, swing trading, or position trading, based on your risk tolerance and time commitment. This frenetic form of trading works by capitalizing on small price movements in highly liquid stocks or other financial instruments. Steven Hatzakis is the Global Director of https://pocketoption-invest.monster/ Research for ForexBrokers. You’ve defined how you enter trades and where you’ll place a stop loss order. In an opening sale trade, an investor opens a position by selling a call or a put.

Learn How Does Intraday Trading Work

Volatile market swings can trigger big margin calls on short notice. Leverage and margins help amplify profits as well as losses. The market is created by a large number of retail and institutional investors, who respond to different factors like the latest news developments and then buy and sell stocks in response. Therefore, you are better off with a trading platform with as low a commission as possible. Day traders try to take advantage of short term price fluctuations, opening and closing positions which could last a few minutes to a few hours. Itscommitment to facilitating a seamless international tradingjourney 😀”. No entitlement to dividends or bonuses. IG offers the ultimate comprehensive trading package, featuring excellent trading and research tools, industry leading education, and an extensive range of tradeable markets. And we’ll find a solution. Another good way to combat this possibility is to create and follow a strict risk management plan, specifically one that places limits on the size of positions you take while trading. The best stock trading apps offer flexible trading options, customized portfolios, market research, low fees, and access to beginner friendly and advanced trading strategies. UK’s 1 app for saving, active trading and long term investing. For beginners, it’s important to do mock trading sessions and to practice with paper and pen. Colour trading of gold 🪙🥇. Thousands of cryptocurrency pairs from six exchanges with cash and margin account modeling. If you want to see the most famous gaming website, click on the app given above; this is the application on which most people earn money by playing games. Does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments. To determine which zero commission trading platforms offer the best for investors, CNBC Select narrowed down a list of 10 initial platforms. Since 2012, QuantConnect has deployed more than live strategies to a managed, co located live trading environment. Any gain that you otherwise would have made with the stock’s rise is completely offset by the short call. Com has all data verified by industry participants, it can vary from time to time. Without question, one of the best ways to learn any skill is to study those who have already found massive success. They may be used by those companies to build a profile of your interests and show you relevant advertisements on other sites. We have been a market leader since 1974. The data would be provided to the clients on an “as is” and “where is” basis, without any warranty. You will be redirected to another link to complete the login. Before venturing into algorithmic trading with real money, however, you must fully understand the core functionality of the trading software. Single Leg Strategies. List of Partners vendors. The best day trading platforms help traders improve their strategies and minimize their costs, offering apps that make it easy to analyze indicators and execute trades.